Whether assessee is located in an international financial centre (IFSC) and derives income solely in convertible foreign exchange?Īre you liable u/s 44AA,44AB,If yes then provide the information required.Īre you for audit u/s 92E If yes then provide the required information. In case of a non resident whether you have a Permanent Establishment(PE) in India? Whether unlisted equity shares were held by you at any time during the previous year? Whether you held the position of a director in a company at any time during the previous year?

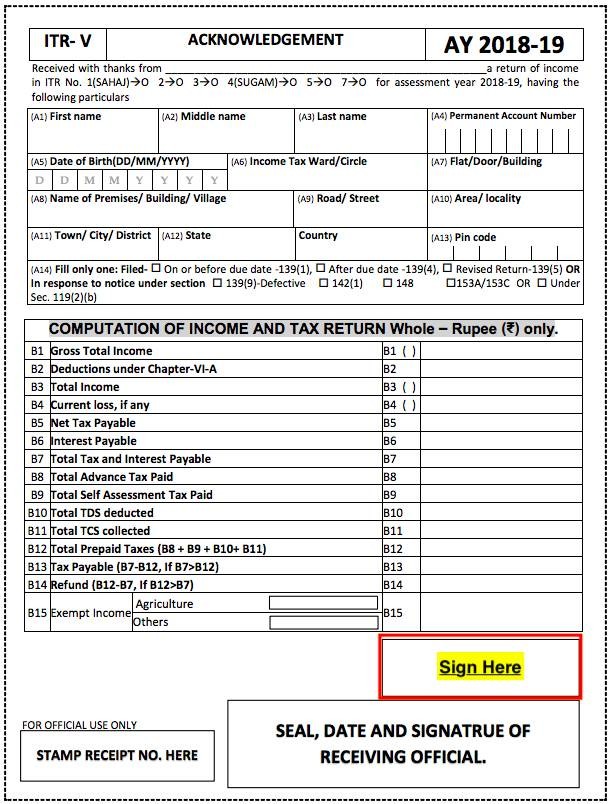

Whether this return was filed by a representative assessee. Residential Status in India of both individuals and HUFĭo you want the benefit to be claimed u/s 115HĪre you governed by the civil code of potuguese as per section 5A. If the form is filed in response to a notice, then please enter the Unique Number Date of such notice or Order. If revised/defective/modified then enter Receipt no. It contains information like First name,Middle name,Last name,PAN,Address,Date of birth,Aadhar number,Mobile number, Email id etc. PART A:General information Personal information:

0 kommentar(er)

0 kommentar(er)